salt lake county sales tax rate

Tax sale will be online through Public Surplus. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and.

Utah Sales Tax Guide And Calculator 2022 Taxjar

Puerto Rico has a 105 sales tax and Salt Lake County collects an.

. 93 rows This page lists the various sales use tax rates effective throughout Utah. This rate includes any state county city and local sales taxes. What is the sales tax rate in Salt Lake County.

The Auditors office calculates certified tax rates for all entities in the county that levy property taxes. Average Sales Tax With Local. Notice of Value Tax Changes will be sent from the Auditors office by mid-July.

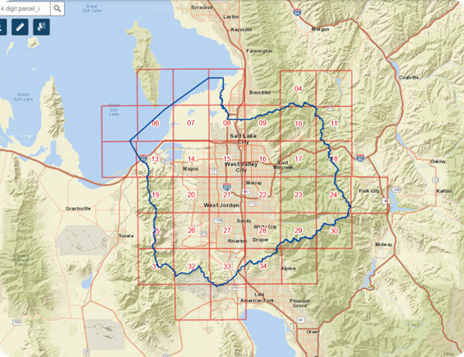

Refer to Rules and. The minimum combined 2022 sales tax rate for Salt Lake County Utah is 725. The total sales tax rate in any given location can be broken down into state county city and special district rates.

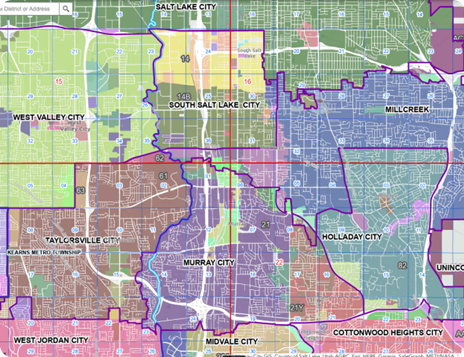

What is the sales tax rate in South Salt Lake Utah. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. The 775 sales tax rate in.

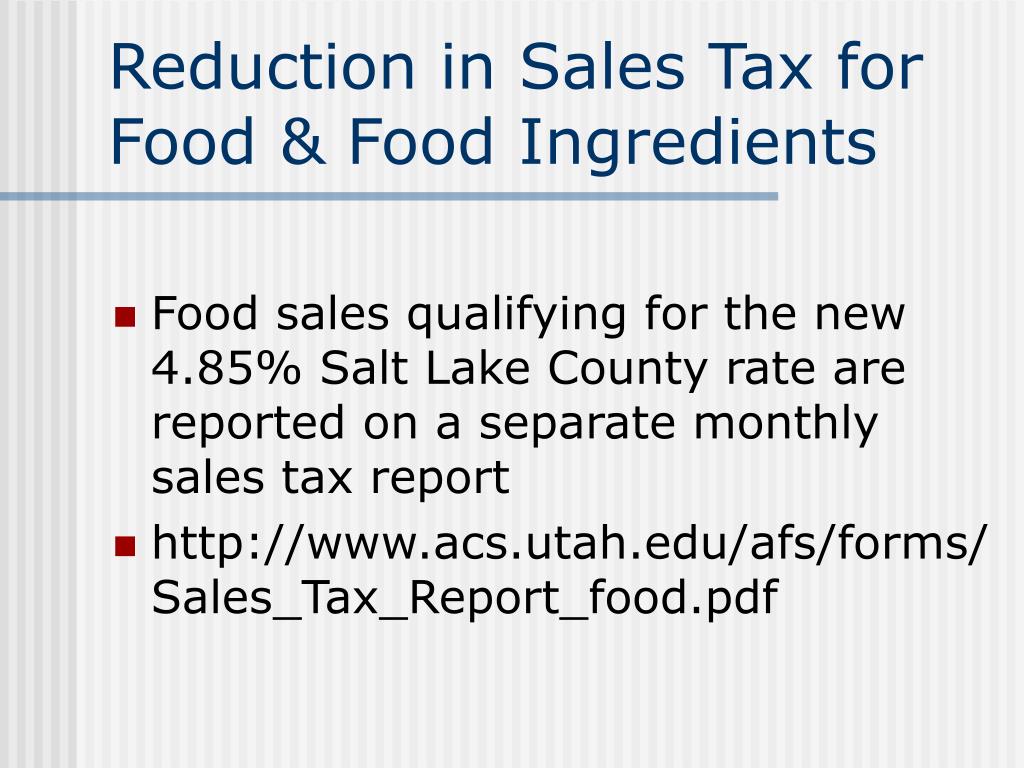

The Utah sales tax rate is currently 485. 2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. The South Salt Lake Utah sales tax is 705 consisting of 470 Utah state sales tax and 235 South Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax a. Welcome to the Salt Lake County Property Tax website.

This rate includes any state county city and local sales taxes. 04499 lower than the maximum sales tax in UT. The certified tax rate is the base.

This is the total of state county and city sales tax rates. Utah has state sales tax of 485. You can print a 775.

This is the total of state county and city sales tax rates. How does the North Salt Lake sales tax compare to the rest of UT. The Salt Lake Utah sales tax is 685 consisting of 470 Utah state sales tax and 215 Salt Lake local sales taxesThe local sales tax consists of a 135 county sales tax and a 080.

This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Salt Lake County Utah is 761 with a range that spans from 725 to 875. The latest sales tax rate for North Salt Lake UT.

Auditors office will start accepting property valuation appeals August 1 through September 15. 2020 rates included for use while preparing your income tax. The minimum combined 2022 sales tax rate for South Salt Lake Utah is.

2020 rates included for use while preparing your income tax deduction. Utah has a 485 sales tax and Salt Lake County collects an additional. The latest sales tax rate for Salt Lake City UT.

The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax 135 Salt Lake County sales tax 05 Salt Lake City tax and 105 Special tax. What is the sales tax rate in Salt Lake City Utah. The latest sales tax rate for South Salt Lake UT.

This rate includes any state county city and local sales taxes. The latest sales tax rate for Salt Lake County UT. A refundable 500 deposit is required by May 23 rd to bid on properties.

2022 List of Utah Local Sales Tax Rates. This is the total of state county and city sales tax rates. The total sales tax rate in any given location can be broken down into state county city and special district rates.

This rate includes any state county city and local sales taxes. This is the total of state and county sales tax rates. Higher sales tax than 94 of Utah localities.

The minimum combined 2022 sales tax rate for North Salt Lake Utah is 725. The tax sale will be held May 26 2022.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

![]()

Tax Information Department Of Economic Development

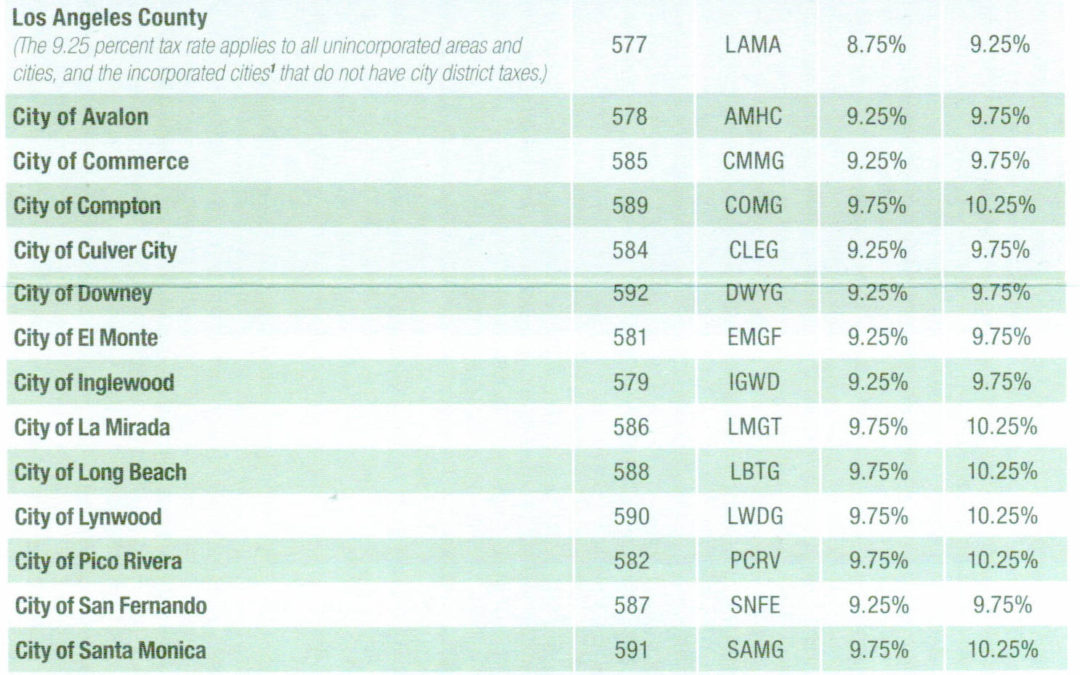

How To Calculate California Unincorporated Area Sales Tax

La County Sales Tax Increase July 2017 Affordable Bookkeeping Payroll

Prop 1 Could Widen Disparity In Utah Sales Taxes

Salt Lake City Utah Tourism Visit Salt Lake

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Ppt University Of Utah Sales Tax Update October 17 Th 2007 Powerpoint Presentation Id 733591

Utah State Income Tax Calculator Community Tax

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State Sales Tax Rates And Combined Average City And County Rates Download Table